What is the state of impact investing? The panel of experts from large institutional investors to small foundations at the 2013 Green Living Business Forum share their thoughts on the growth potential, risks and opportunities, and the valuation of social and environmental factors. Six common threads emerged from the discussion chaired by CBC host Evan Solomon.

What is the state of impact investing? The panel of experts from large institutional investors to small foundations at the 2013 Green Living Business Forum share their thoughts on the growth potential, risks and opportunities, and the valuation of social and environmental factors. Six common threads emerged from the discussion chaired by CBC host Evan Solomon.

Impact investing is small but rapidly growing. Currently it accounts for $50 billion globally, according to Bart Houlahan, Co-Founder of B Lab, a non-profit that helps entrepreneurs solve social and environmental problems. While this is a very small part of the capital markets, it is the most rapidly growing segment.

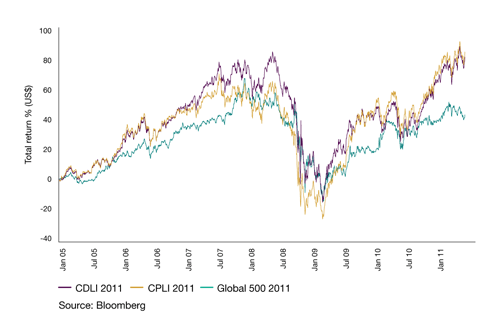

Investors assume impact investing means giving up profits. According to Jane Ambachtsheer, Partner & Global Head of Responsible Investment at Mercer, some investors and investment managers think impact investing means giving up profits and from a fiduciary point of view they are not allowed to do that. Data actually shows the opposite to be true. If you invested in the Global 500 companies in 2005 you would have a total return of approximately 40% by 2011. That’s not bad. But if you put your money in companies in either the Carbon Disclosure Leadership Index (CDLI) or the Carbon Performance Leadership Index (CPLI), your return would have been approximately 80%. Over this six year period, companies that devoted resources to managing their carbon delivered double the return to their investors than companies that did not. Doing good equals doing well. See more details in my article CDP Canada 2011: Key Highlights.

“Impact investing can provide good return on investment,” according to Julia Langer, Chief Executive Officer of Toronto Atmospheric Fund, a fund who has invested more than $50 million in local climate solutions and has helped Toronto save more than $55 million on its energy bills. “It’s not just about feeling good. But you need to know how to value it.” For more on how environmental, social and corporate governance (ESG) factors are valued by the financial industry, see my article Investment Bank, VC, Credit Rating Agency Talk Sustainability.

Investors don’t know how to value climate change risks in their portfolio. They either don’t realize or don’t know how to deal with the climate change related risks in their investment. If you hold stocks in BP or Shell, how much climate change related risks are there in those investments? Analysts at HSBC found those investments could face a loss in market value of up to 60% should the international community stick to agreed emissions reduction targets. The analysts found a massive over valuation of oil, coal, and gas reserves held by fossil fuel companies. This carbon bubble could lead to another financial crisis, according to Lord Nicholas Stern, a professor at the London School of Economics. His warning is supported by Citibank, Standard and Poor’s and the International Energy Agency. There is also arguably a water bubble in the market, says Ambachtsheer. Investors have exposure to these underlying bubbles but few know how to value them, or even know they exist. These resources need to be priced appropriately and knowledgeably.

Both Langer and Ambachtsheer think more people who are able to talk about impact investing issues should be sitting on investment committees so that they can conduct these dialogues knowledgeably. Increasingly, shareholders are filing proposals and resolutions to managements related to climate change, environment, and sustainability issues. I highlighted six examples in the article Investors Increasingly Concerned With Climate Change Risks.

There’s a language barrier between the sustainability and financial communities. For their part sustainability practitioners can help this cause by being able to talk in the language of investors. Houlahan of B Lab suggests that discussing impact investment using hard measures and common investment metrics would make it easier to move this discussion into the mainstream investment space, allowing analysts to directly compare impact investments to conventional investments.

Externalities continue to distort the markets. If the costs related to pollutions, health care, and other externalities resulting from fossil fuels are priced directly into the energy then we would have a “much truer economy,” according to David Martin, co-founder & general partner at Capital for Aboriginal Prosperity and Entrepreneurship Fund. Indeed, the International Monetary Fund found that Canadian governments spent $26 billion in 2011 subsidizing energy. That works out to be $787 of energy subsidies per year for each Canadian. (See: The Real Price We Pay for Fossil Fuel Energy) The U.S. figures are even higher: $4.7 trillion in total, or $1,611 per year for each American. This is a case where the public picks up the costs while the shareholders pick up the profits, says Martin. As more and more of our economy are owned by foreigners, these profits may not even stay within the country.

Regulations could promote progress. Eight countries around the world have implemented requirements for hatch funds and other institutional investors to disclose how they are addressing ESG factors, according to Ambachtsheer. “These regulations have been very effective. It forces the investment committee to talk about these factors and show us what they are doing. We wouldn’t tell them what to do but it would force them to put it on their agenda.” For public company disclosure requirements in Canada, see New Environmental Disclosure Guidance From Canadian Regulators.

The climate is bringing change to the way we should value our portfolio. Whether it is for financial return, doing the right thing, or both, we need to learn to adapt. Or as the President of Strategic Sustainable Investments Tim Nash likes to put it: Don’t let your money do what you wouldn’t.

Images: Green Living Show

6 key points from Impact Investing Forum @evansolomoncbc @BCorporation @JuliaLanger #GLS13 http://t.co/NYG53YDMsL http://t.co/EvzWOBXEbq

RT @Carbon49: 6 key points from Impact Investing Forum @evansolomoncbc @BCorporation @JuliaLanger #GLS13 http://t.co/NYG53YDMsL http://t.co/EvzWOBXEbq

RT @CBSRNews: The State of Impact Investing: from the @GreenLivingPage Business Forum by @Carbon49 #gls13 http://t.co/2pmSNEZ2Tc #SRI #CSR

The State of Impact Investing: Green Living Business Forum http://t.co/mofx2JactS #impinv #impactinvesting

RT @grabinovici: The State of Impact Investing: Green Living Business Forum http://t.co/mofx2JactS #impinv #impactinvesting

RT @Carbon49: 6 key points from Impact Investing Forum @evansolomoncbc @BCorporation @JuliaLanger #GLS13 http://t.co/NYG53YDMsL http://t.co/EvzWOBXEbq

[…] who invest heavily in combating climate change are doing for their shareholders. As I wrote in The State of Impact Investing in 2013, “some investors and investment managers think impact investing means giving up […]

[…] who invest heavily in combating climate change are doing for their shareholders. As I wrote in The State of Impact Investing in 2013, “some investors and investment managers think impact investing means giving up […]